Japan’s Real Estate Market: World of Substantial Opportunities

Japan’s Real Estate Market: Attracting Capital from Abroad

In August 2023, the Japanese government seized the opportunity to break free from a deflationary cycle that had persisted for about 25 years. It partnered with the Bank of Japan to revitalize the economy.

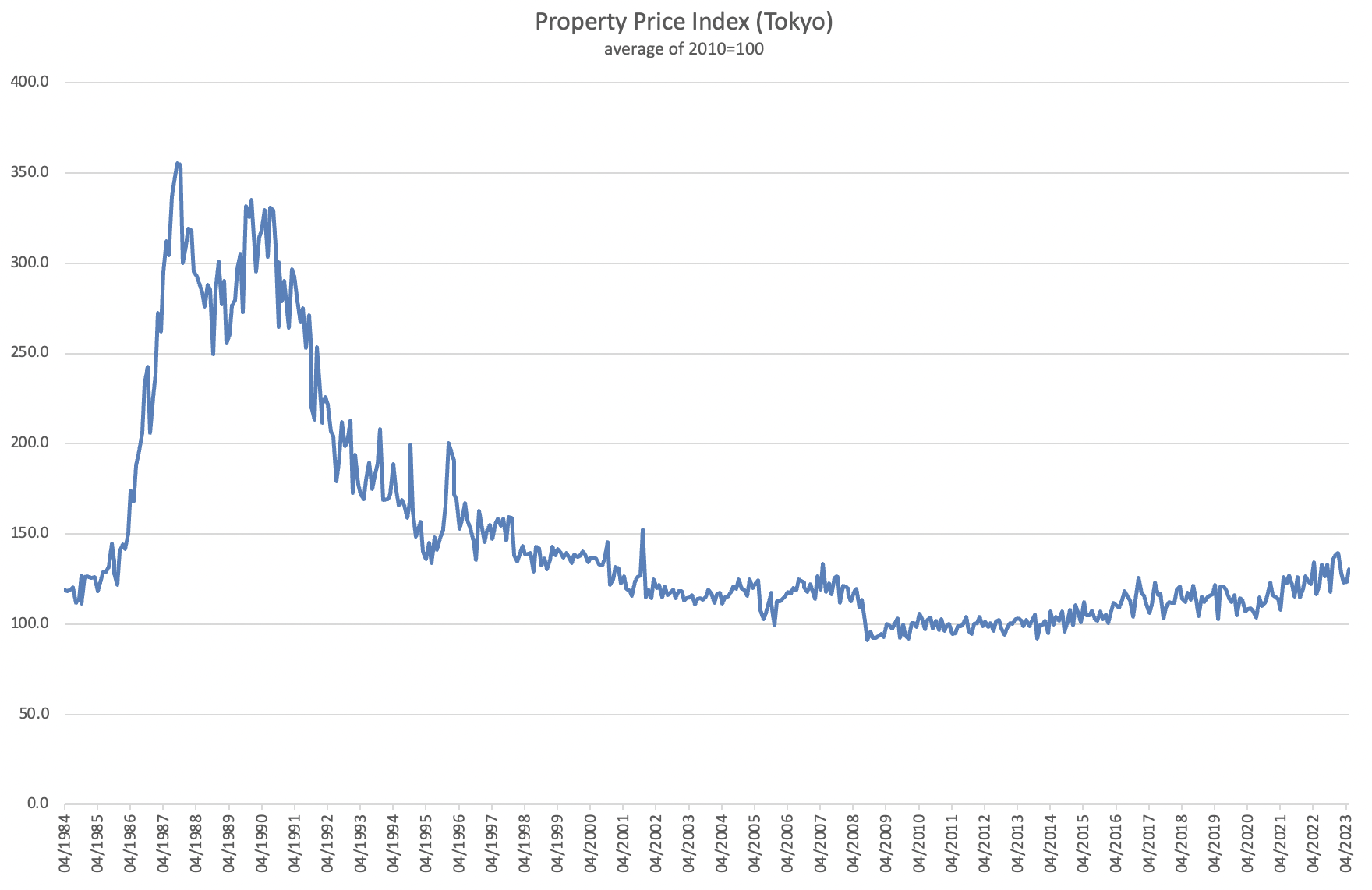

This prolonged deflation not only affected prices and wages but also took its toll on real estate values. The decline in real estate prices was the catalyst for Japan’s “Lost 30 Years” since the burst of the economic bubble in the late ‘1980s.

Due to deflation, Japan’s real estate appears relatively affordable on a global scale. Even as the economy has recovered from the impact of the Lehman shock, real estate prices remain at only about 30% of their levels during the bubble era.

In this scenario, wealthy individuals from the United States, the European Union, and across Asia are expanding their investments in Japanese properties, both for investment and residential purposes. In recent years, real estate investment in Japan has become a popular alternative to stocks, particularly among foreign investors.

Moreover, the depreciation of the yen over the past few years has accelerated real estate investments. Since the onset of the COVID-19 pandemic, the yen has weakened by more than 30% against the dollar, making Japanese properties even more attractive.

Let’s examine Japan’s real estate market from a foreign investor’s perspective, exploring both its merits and risks.

Merits for Foreign Investors

Liveable Cities

According to The Global Liveability Index 2023, Japan stands out with Osaka at 10th place and Tokyo at 15th. In the 2020 ranking, Tokyo had even secured the top position globally.

The “liveability” of Japanese cities underscores the strong demand for real estate, particularly in urban areas, where property prices remain stable. They tend to recover quickly after brief declines.

This liveability isn’t confined to just metropolitan areas; it’s a national characteristic. Japan boasts political and economic stability, low crime rates, excellent public transportation, and various other attributes that make it a world-class destination.

Furthermore, Japan is known for being an accommodating home for foreign residents. In particular, Minato Ward, one of the wealthiest cities, has approximately 10% of its population consisting of foreign residents. These areas are foreigner-friendly, with multilingual signage and services, making it a comfortable place for international residents.

The ability to live comfortably is a crucial factor in real estate investment.

Low Country Risk

Japan is globally recognized for its low country risk. In the OECD’s Country Risk Classification, Japan holds an ‘A’ rating, which is the best category.

In Asia, only Japan and Singapore are awarded ‘A’ ratings. In contrast, countries like China and India, which together constitute 40% of the world’s population, receive ‘C’ and ‘D’ ratings, respectively.

Recent geopolitical risks associated with the locations of certain countries have highlighted the importance of geopolitical risk in the context of economic impact. Japan, despite territorial disputes with neighboring nations, is generally considered a balanced and low-risk country in terms of geopolitics.

The minimal country risk and geopolitical stability make real estate investment in Japan a safe and steady option. Unlike rapidly developing nations where property prices could skyrocket but also carry a significant risk of a sudden fall, Japan offers a safer investment with the potential for modest yet consistent growth.

Low Hurdles for Foreign Buyers

Japan does not impose strict regulations on real estate purchases by foreigners. Property ownership is possible not only for foreign residents with permanent residency but also for non-resident foreigners.

Many major cities have real estate agencies specializing in serving foreign clients, ensuring that real estate transactions can proceed smoothly, even for those who do not speak Japanese.

Risks and Disadvantages in Japan

Earthquake Risk

The most significant risk associated with real estate investment in Japan is undoubtedly earthquakes. The 2011 Great East Japan Earthquake serves as a recent reminder, and there is a possibility of significant seismic activity in the future.

Mitigating earthquake risk in Japan involves two key factors: earthquake insurance and the compliance of purchased properties with modern seismic standards. Earthquake insurance provides compensation for damages to buildings and personal property caused by earthquakes, and its relatively low monthly cost makes it advisable for properties of all ages. Furthermore, buildings constructed according to modern seismic standards, established since 1981, are designed to withstand strong tremors, reducing the risk of structural damage during a seismic event.

Rising Interest Rates and Increased Loan Burden

Interest rates are high in many countries worldwide. Currently, policy interest rates in Europe and the United States are at or above 5%.

In response, the interest rates on loans, including housing and investing loans, have also increased. While interest rates in most major countries are generally in decline, there is a possibility that loan interest rates will remain at elevated levels.

Although real estate investment can be an attractive option for leveraging loans to generate high returns with minimal personal capital, high-interest rates may result in loan repayments surpassing investment income.

In Conclusion

From the perspective of foreign investors, Japan’s real estate market is characterized as affordable and stable.

Japan’s real estate prices have been on an upward trend in recent years, but the country still offers a wealth of low-priced property opportunities. This presents a significant opportunity for foreign investors.